USDJPY forecast - Impact of Abe's resignation on the Yen

03 Sep 2020

The Japanese Yen (JPY) is one of the most traded Asian currencies in the financial markets. And its pair with the US Dollar – USDJPY, forms one of the four major currency pairs, which are some of the most traded currency pairs in Forex.

Since December 2016, the USDJPY has been on a bearish trend implying the Japanese Yen has been bullish. And that trend played well into the current economic crisis around the world due to the COVID-19 pandemic.

The US dollar has had the hardest blow following the effect of the pandemic in the US, which has greatly affected businesses there.

On August 27, 2020, U.S. Federal Reserve Chairman Jerome Powell, unveiled Fed’s tactic to the current inflation. However, the speech hinted that the current low rates will continue for a longer period. Following Powell’s speech, the USD index used to track US Dollar greenback against other currencies registered a drop of about 0.09%.

As the strength of the US Dollar continues to drop, the Japanese Yen, on the other hand, seems to be gaining ground.

Shinzo Abe’s Resignation

Following the announcement that the current Japanese Prime Minister, Shinzo Abe, will be stepping down, there was scepticism of how the Japanese Yen will behave in the market with some fearing that there could be a shift in policy in Japan.

However, since the ruling Liberal Democratic Party in Japan still holds power, experts do not see a significant shift in Policy. The party is to elect its leader on September 14, 2020.

Read moreDivergence in Coravirus responses among countries provide Forex trading opportunity

21 Aug 2020

Coronavirus continues to be one of the more significant factors in determining the future direction of Forex markets. The divergence in the Covid-19 situations in different countries can provide direction in corresponding currency pairs. The U.S. is an outlier in the severity of the coronavirus situation compared to much of the rest of the world. This can have a bearish effect on the U.S. dollar when trading against the currencies of other countries that have been effective in suppressing the infections within their borders.

Worrying coronavirus situation in US

The Covid-19 situation in the U.S. may continue to weigh on the U.S. dollar, especially if the rest of the world recovers relatively faster. Much of the situation has been exacerbated by the incompetent and arguably negligent response by the Trump administration. With the U.S. still at relatively higher rates of deaths in proportion of population compared to many other countries, it might be a good idea for Forex traders to identify countries which have a much lower spread of coronavirus. Using the currencies of these countries to trade against the U.S. dollar can result in serious profits for currency traders using a reputable Forex broker.

AUD/USD

One country which has seen much more success than the U.S. and most other countries in containing the spread of the virus is Australia. There are only two Covid-19 deaths for every 100,000 people in Australia while the U.S. has 26 times more at 53 coronavirus deaths for every 100,000 residents. Australia has largely avoided the rate of infections of the rest of the world due to strict lockdown measures taken. Although this has undoubtedly hurt the economy, it has also cemented the public’s trust in the government’s leadership, profoundly contrasting with the deteriorating confidence in the U.S. government’s competence.

Despite the drag on growth due to coronavirus lockdown measures, economic data coming out of Australia has been notably positive. Manufacturing and services industry data is suggesting growth while June retail sales increased by 2.7%. Also, The country’s trade surplus came in at 8.2 billion AUD in June which is an increase from the previous month at 7.34 billion AUD. Additionally, macroeconomic data from China, Australia’s largest trading partner, is also suggesting economic growth. All of these factors are bullish for AUD.

Read more

Gold on Sharp Bullish Trend as UD Dollar Continues on Bearish Trend

12 Aug 2020

The ongoing economic crisis curtsy of the COVID-19 Pandemic seems to have given Gold a chance to regain its lost glory.

In just a couple of months, the price of the yellow metal has risen past its 2011 all-time high of $1,900 an ounce. The metal is currently selling at over $2,030 an ounce.

US Dollar is bearish for three months consecutively!

It is such a coincidence that as Gold prices rise, the most popular and dominant reserve currency in the world, US Dollar (USD), is facing a financial crisis following the COVID-19 pandemic.

The US dollar has been on a bearish trend for the last three months with no foreseeable future of its end as COVID-19 continues to wreak havoc in the US and around the world.

There were hopes that the US Dollar would start recovering after Friday’s job report, but that has not been the case.

Compared to some of the other world leader currencies like euro (EUR), Canadian Dollar (CAD), Great Britain Pound (GBP), Japanese Yen (JPY), Swiss Franc (CHF) and Australian Dollar, the Dollar has been dropping. It has also been performing poorly against metals such as the Gold and Silver.

Read moreWaning US credibility and other factors weighing on dollar

06 Aug 2020

When the coronavirus crisis first hit the U.S., traders immediately began to buy safe haven currencies, such as the U.S. dollar. Since the dollar index hit its peak in mid to late March, the dollar started falling based on the economy in the U.S. and the rest of the world beginning to reopen. The dollar then traded in a range from late March to mid-May. At that point the dollar fell off a cliff and continued to rapidly depreciate since then. There are many factors weighing heavily on USD but the currency’s safe haven status is now in question.U.S. credibility risk for dollar

The reason the U.S. dollar was at first considered a safe haven by investors was due to the strength of the American economy which traders perceived to be better suited to absorb the damage from Covid-19 and then recover quickly. However, the Trump administration’s lack of leadership on tackling the virus has seriously damaged the credibility of the U.S. government. President Trump’s messaging on the pandemic is muddled and confusing, swaying from full-on anti-mask denialism to suddenly promoting mask-wearing as a sign of patriotism. This has put into question the government’s competence and also the American economy’s ability to recover from the crisis.

As a result, when market sentiment turns risk-averse the USD may, instead of appreciating as a safe haven asset, like it did during the beginning of the coronavirus crisis in the U.S., the dollar may end up going the opposite direction. This can be a lucrative opportunity for traders who are able to short the U.S. dollar at the right time. As long as you have a reputable Forex broker you should be able to capitalize on future market fluctuations.

Read moreUS dollar safe-haven status in jeopardy over coronavirus uncertainty

21 Jul 2020

Lack of clarity regarding the macroeconomic picture for the U.S. is making the long-term direction of markets more challenging to predict. The unprecedented amount of effort being put into research for coronavirus treatments is providing some hope for risk sentiment in the Forex markets. However, U.S. economic data has been mixed while the Trump administration’s resistance to taking Covid-19 seriously is dampening risk-on sentiment and continuing to isolate the U.S. from the rest of the world.

The race towards Covid-19 treatments provide hope

One of the unknown factors which can have huge ramifications on the market is if and when an effective coronavirus vaccine will be available for widespread use by the public worldwide. On the heels of news of Pfizer and BioNTech achieving Food and Drug Administration (FDA) fast-track status for two coronavirus vaccines, University of Oxford has just reported promising results for recent trials of its own vaccine. Breakthroughs in Covid-19 treatments are providing strength in risk-on sentiment which can be bearish for safe-haven assets, such as the U.S. dollar and Japanese yen.

Read more

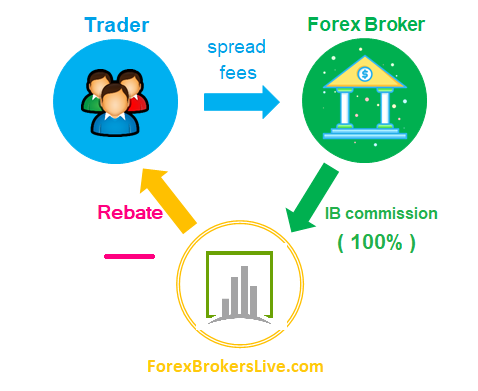

Understanding How Commission Forex Rebates Work

16 Jul 2020

Forex rebates are a great way of boosting your forex profits. But what are they and how do they work?

If you are a forex investor or a beginner looking to start trading forex, you will have to create a trading account with a reputable forex broker. The broker is the one that provides you with the online platform where you can perform trading.

However, the broker is in it for money and is also looking to make profits like any other business. But how do they do that?

Brokers make money from charging commissions, swaps, and spreads on the financial instruments they offer for trading on their platforms. Some brokers only charge spreads, while others charge commissions especially ECN brokers. Other brokers charge both by offering accounts where spreads are charged and other accounts where commissions are charged.

The spreads and commissions, however, lower the profits of traders. The larger the spread and commissions the lower the profits for traders.

Let us take an example: if a trader is using a broker that charged a commission of $7 per lot, it means that for every profit that the trader makes per lot, they will have to be charged $7. If the trader was trading with a broker that does not charge commission, they would not part with that $7.

Read moreEconomic recovery on horizon, coronavirus dampens hopes

14 Jul 2020

Now that all regions of the world have felt the devastating effects of the coronavirus, some of the negative factors have been priced into the markets. However, the future is far from clear with uncertainty looming around how quickly the world economy will be able to recover. So far, much of the economic data coming out after the crisis has spread throughout the globe has been supportive of risk-on sentiment.

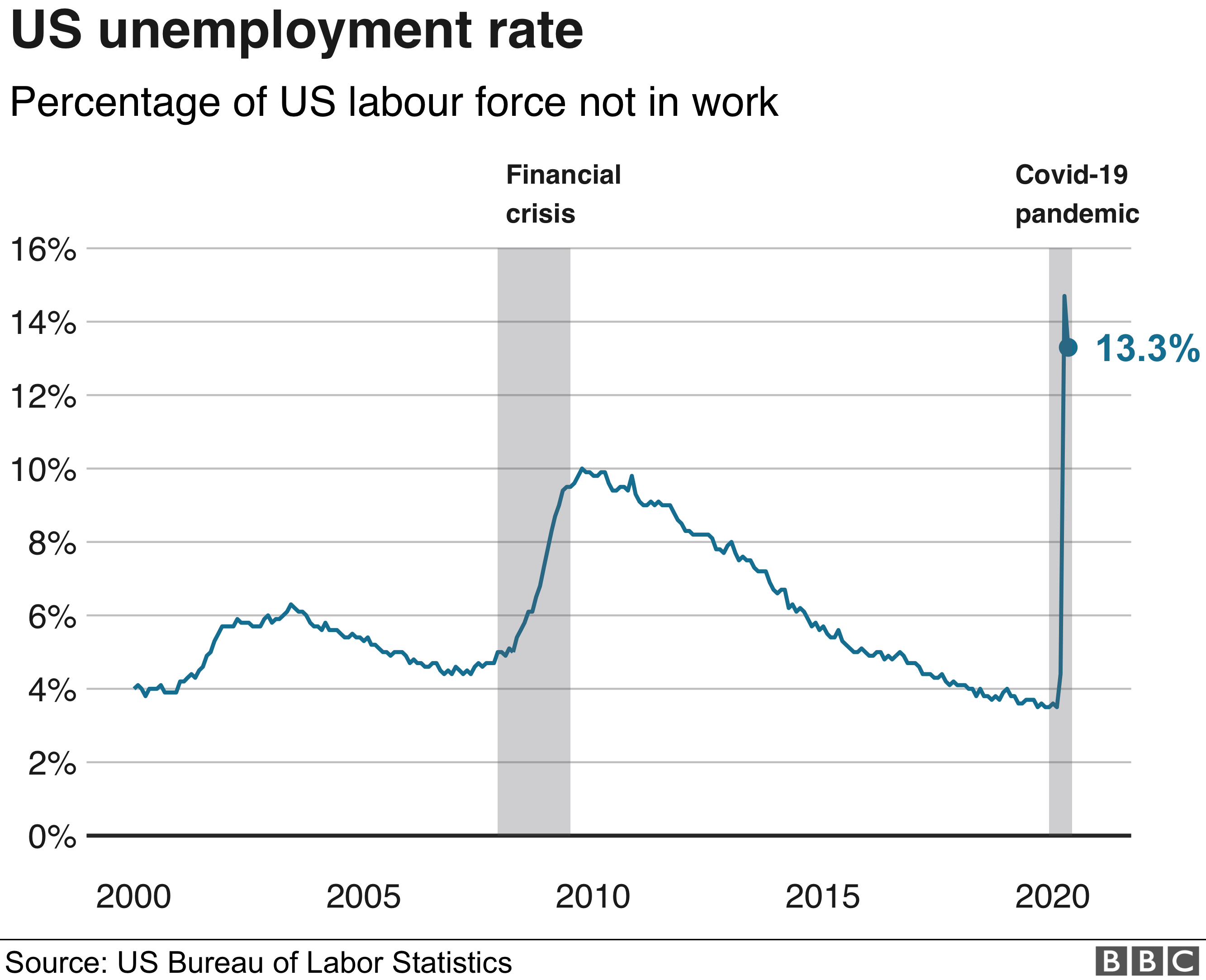

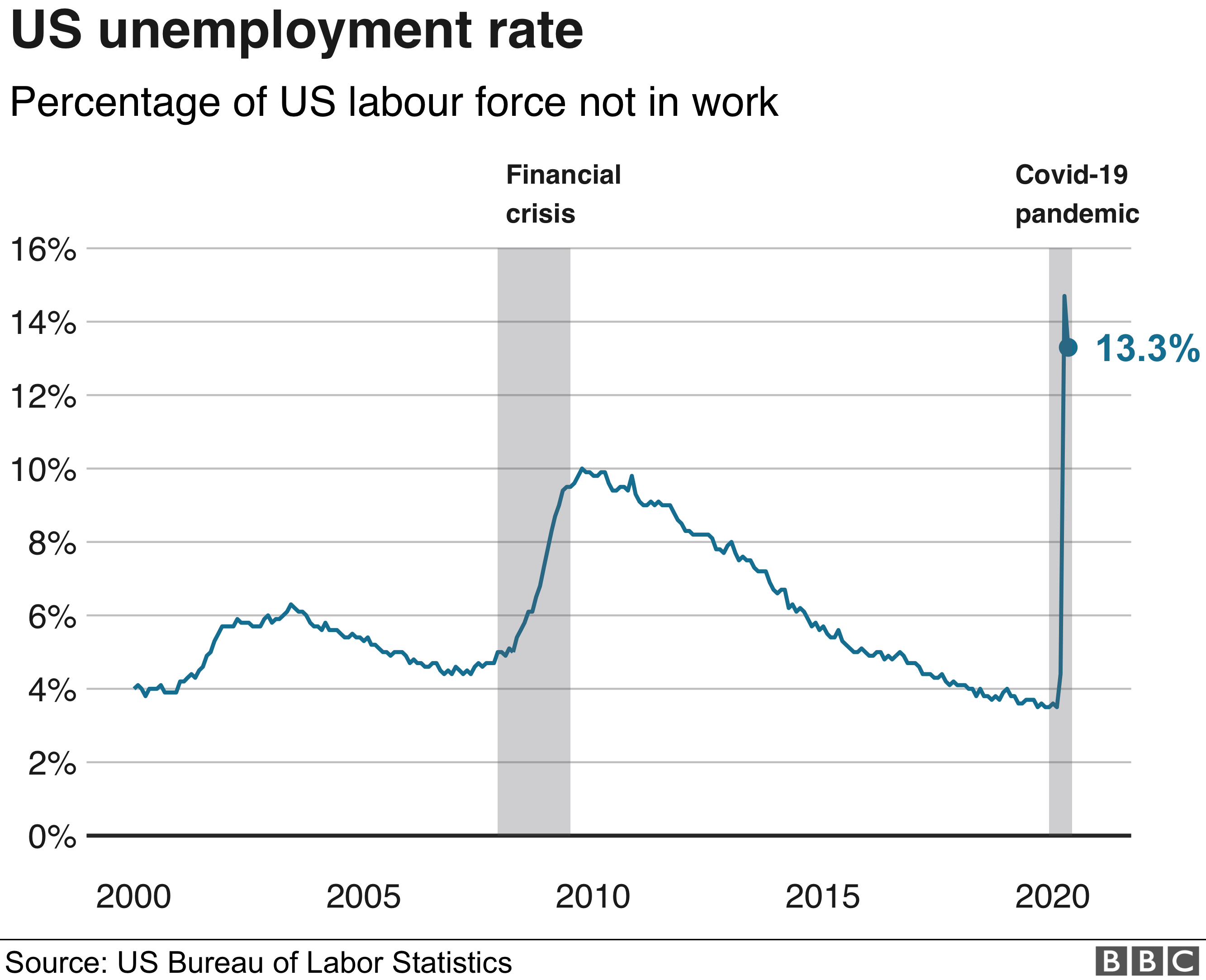

US employment better than expected, but still bad

Much of the U.S. data has been better than estimates, but comes amidst the backdrop of historically low expectations and record high unemployment around the world. In the largest economy in the world, the June 2020 jobs report showed non-farm payrolls rising by 4.8 million compared to an expected 2.9 million. The unemployment rate fell to 11.1% which is significantly better than the expected 12.4%. However, this good news comes in the face of an unemployment rate that had just recently hit a record high of 14.7%.

Positive economic data from the U.S. will help to quicken the declining dollar since this currency has been used as a safe-haven asset for investors. Forex traders will want to be on the lookout for significant potential for profit in shorting USD. Finding a reputable broker will empower investors to not miss out on this opportunity.

Rest of world shows signs of recovery, uncertainty still remains

The market seems to be somewhat optimistic on China’s recovery with exports looking to be better than expected. In the U.K. the Bank of England is signaling optimism on the recovery in a recent statement from Governor Andrew Bailey. Germany’s Economy Ministry has also noted signs of recovery in that country’s economy, speculating that German industrial production may have hit a bottom. On the other hand, there is still much uncertainty as to how and when the coronavirus crisis will be resolved. Unexpected bad news on this front can reverse the risk-on sentiment, turning the markets more cautious.

Read more

Is Forex trading legal in India?

05 Jul 2020

Yes, Forex trading is legal in India. However, there are very strict rules which brokers and traders should adhere to.

Who regulates forex trading in India?

The top forex regulatory authority in India is the Reserve Bank of India (RBI). It is guided by the regulations captured in the Foreign Exchange Management Act, 1999 (“FEMA”).

The RBI simply regulates the laws and also passing key approvals.

The rules under the FEMA Act apply to all citizens of India either living in India or outside India as wells as any foreign nationals or entities operating in India. Therefore, if a forex broker is not based in India and wants to offer services to Indians, they have to comply with the rules set in the FEMA. The FEMA Act regulates every foreign exchange trade and payments and it has direct implications on them.

What are the rules of trading forex in India?

Forex trading is restricted to those currency pairs that have the Indian Rupee (INR). Therefore, for any Indian national/citizen to trade Forex, they should only trade those pairs that have the INR or cross-currency futures contracts allowed by the RBI.

Read more

Forex Risk Management Tips

03 Jul 2020

At the bottom of every forex broker’s webpage, there is always a disclaimer that forex trading is risky. But that does not mean it is not a good investment opportunity. Forex trading is one of the best ways of making money online, though only if the risks involved are well taken care of.

What does Forex Risk Management involve? It is simply a combination of strategies that traders can use to minimize the risk of losing their investment or better put, to maximize their profits.

Before we get into the risk management tips, it is important to point out that in forex there is always losses and profits. There is no trading strategy that is 100% accurate to make only profits every time. A successful forex trading strategy is that strategy that makes more profits than losses so that the sum of the two is positive and not negative.

Tips of how to manage forex trading risks

1. Get a reputable regulated broker

Choosing a forex broker is always the first step when starting to trade forex. There are lots of forex broker scams out there and you should do due diligence to ensure you don’t fall into their hands.

Read moreBrexit and weak macroeconomics provides opportunity for shorting GBP

29 Jun 2020

Great Britain has recently had its share of hard times, from Brexit to coronavirus and all of the economic challenges these two problems created. The coronavirus pandemic has caused immense economic damage all over the world with national governments being forced to shut down their economies, while the U.K. was no exception. Also, the U.K. and the EU have just recently restarted their trade talks over the terms on which the U.K. will be leaving the EU. The Brexit situation has resulted in uncertainty for businesses in Great Britain that depend on cross border trade with the EU, therefore sapping economic activity and impeding the U.K. economy’s recovery from the pandemic-caused recession. The uncertainty has resulted in weakness in the GBP across the board which means significant opportunity for Forex traders to profit from market moves against GBP.

Brexit negotiations

Traders should keep a keen eye on the latest news regarding the Brexit negotiations. The fear is that the two sides will fail to come to a compromise agreement which would mean that the U.K. will leave the EU without a trade deal. This could mean chaos in many supply chains, hurting businesses in the U.K. Therefore, if any news is leaked suggesting disagreement between the two sides and an inability to compromise, this will likely result in weakness in the British pound.

Read more

Verifying that your forex broker is legit and not a scam

25 Jun 2020

Forex trading is one of the most promising investment opportunities around the globe today. The forex market is one of the largest financial markets by volume of over $7 trillion being traded per day, which makes the market highly liquid. Another advantage is that it has no geographic boundaries and any party can participate as long as they find a forex broker that allows them to trade.

Nevertheless, not all that glitters is gold. The English men also said that when the deal is too good think twice. And this applies in the forex market. Due to its glamour and lucrativeness, scammers have flocked the internet in the name of forex brokers and it has become difficult to distinguish legit forex brokers from forex brokers that are just scams looking to pawn on malleable forex investors.

But how do you get off the hock? How do you navigate the treacherous waters to find a legit forex broker?

We are going to go through some tips to help you in identifying genuine forex brokers.

Tips of identifying legit forex brokers

1. Look for the regulation

There are regulatory authorities in different countries that are mandated with ensuring that financial market institutions like forex brokers operate in a manner that is safe for investors. In short, the regulatory authorities keep the brokers in check to ensure they do not indulge in fraudulent activities.

Read moreUSDJPY confused, emerging market currencies provide clarity

23 Jun 2020

One useful and common way to look at the Forex markets is through a “risk-on” versus “risk-off” lens. This generally pertains to market optimism regarding future global growth and economic activity. When the market broadly believes that global economic growth is set to decrease in the future the market is said to be in a “risk-off” mood, resulting in appreciation of certain securities known as “safe-haven” assets. Having knowledge of these assets can help Forex traders to profit from lucrative safe-haven trades..

US dollar currently safe-haven

In Forex, the currencies which have traditionally been considered safe-haven assets are the Japanese yen and the Swiss franc. However, there are times when other currencies start behaving like safe-haven assets, due to traders perceiving the economic and geopolitical situation of the issuing countries to be stable in comparison to the rest of the other countries issuing currencies traded on the Forex market. At the moment, the US dollar has been behaving like a safe-haven currency.

On the other hand, regardless of the safe-haven status of any currency, there is always the potential to capitalize on fluctuations in the Forex markets. Just make sure you choose a reputable Forex broker with a stable trading platform for accessing the currency markets.

Read more

Coronavirus resurgence creates opportunities in safe-haven currencies

16 Jun 2020

Since the United States and other countries around the world have begun to reopen their economies after shutting down due to the coronavirus crisis the markets have swung towards a more risk-on sentiment. This has resulted in the U.S. dollar depreciating rapidly while strengthening emerging market currencies. The U.S. dollar index has been rapidly declining since mid-May on hopes that the reopening of the world economy will spark pent-up economic activity from consumers and industry. On the other hand, there are still significant risks from a potential second wave of coronavirus infections which threatens to quickly reverse the risk-on mood of the day.

Risk-on sentiment

However, there are real reasons to be optimistic. The Federal Reserve has announced it will be providing massive stimulus in the form of buying corporate bonds, resulting in the U.S. dollar weakening while commodity-linked and emerging market currencies strengthened on the news. This occurred within the context of recent positive employment numbers coming out of the U.S. Also, the latest retail sales data showed a surge in the U.S. retail sector during the month of May, further providing hope that the U.S. economy is recovering faster than expected.

Read more

How to identify the right Forex broker for you

09 May 2020

Are you searching for the ideal Forex broker? Are you unsure about the small details that you need to keep an eye on? In this following article, you are going to find out all the top points about identifying the right Forex broker for you. This analysis will range from a preferred type of account, types of instruments as well as some solid warning tips in order to avoid any kind of fraudulent brokers.

What is a Forex Broker?

In order to start trading foreign currency, you first need to identify a robust forex broker. A complete definition states that a broker is a firm that enables a trader to access a trading platform in order to place buy and sell actions on various currencies. It is very important to keep in mind that research needs to be carried out first before signing up with a new broker. You need to make sure that they have a positive reputation.

Here is a short and comprehensive list that traders should take into consideration when picking the ideal broker:

1) The Variety of Trading Tools

It is highly important to invest with the right trading tools at the same time on different trading markets. A smart idea is to pick an FX broker which can provide a wide array of trading markets to access this can also include CFDs, indices, stocks, and cryptocurrencies.

Read more